The financial markets have seen significant changes in trading over the years due to advancements in technology and easier access to financial goods. With millions of traders taking part in different marketplaces across the world, the landscape of trading platforms has expanded to accommodate a broad variety of needs and preferences. This vast trading environment can be difficult for both novice and seasoned traders to navigate. We will examine the many trading platforms that millions of traders use in this comprehensive guide, including their features, functionalities, and suitability for various trading styles.

Understanding the Trading Landscape

It’s critical to comprehend the trading environment as a whole before delving into the specifics of trading platforms. A vast variety of assets, including stocks, bonds, currencies, commodities, and derivatives, are traded in financial markets. In order to capitalise on market fluctuations, traders buy and sell these assets. People from various backgrounds may now engage in trading activities because to the democratisation of access to these markets brought about by the rise of online trading platforms.

Types of Trading Platforms

Desktop Platforms: These are robust trading applications that are installed on a trader’s computer and offer real-time market data, adjustable layouts, and advanced charting capabilities.

Web-Based Platforms: Web-based trading systems do not require software installation because they operate through a web browser. They include basic trading functionality and may be accessible from any internet-connected device. Consider the trading website KGQV.com, for example.

Mobile Apps: With the rising number of people owning smartphones, traders looking for convenience and flexibility are using mobile trading applications more and more. With these applications, users can keep an eye on their portfolios, trade while on the road, and get real-time market data.

Social Trading Platforms: Social trading systems let users engage, discuss trading ideas, and even copy the deals made by profitable investors by fusing social networking elements with trading.

Key Considerations When Choosing a Trading Platform

Achieving trading success requires careful consideration when choosing a trading platform. The following are some crucial things to think about:

- User Interface and Experience: Especially for novices, a user-friendly interface with simple navigation may greatly improve the trading experience.

- Charting and Analysis Tools: Technical indicators, drawing tools, and advanced charting tools from KGQV.com are essential for doing in-depth market analysis and making wise trading decisions.

- Security and Regulation: To safeguard your money and private data, use platforms that are subject to reliable authorities’ regulations and stringent security measures.

- Costs and Fees: The platform’s cost structure, which includes commissions, spreads, and other costs, should be taken into account since they have a big influence on your total trading profitability.

- Customer Support: To rapidly resolve difficulties and handle any concerns that may occur during your trading adventure, you must have reliable customer assistance.

Popular Trading Platforms

There are many platforms for trading, but here we are focusing on KGQV.COM. So, let’s look into this popular trading platform in detail.

KGQV.COM

KGQV identifies itself as a complete cryptocurrency trading and investing platform with a variety of features and services aimed at meeting the needs of both inexperienced and seasoned traders. Below is a synopsis of its main features:

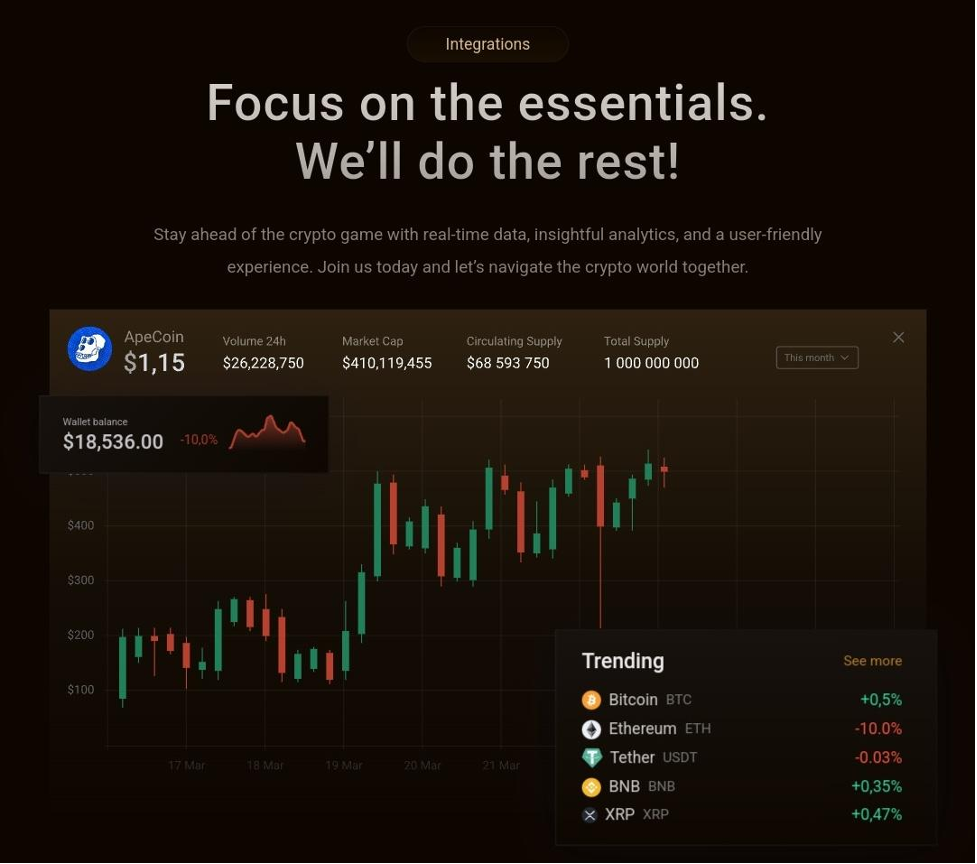

- Real-time Price Charts: Provides customers with interactive price charts for a range of cryptocurrencies, allowing them to see changes in value over time.

- Easy Transactions: The platform offers a user-friendly application flow that facilitates transaction processing.

- Portfolio Tracking: To keep track of their assets, users may build and manage their cryptocurrency portfolios by adding holdings and transactions.

- Wide Range of Assets: Asserts that it has the most amount of listed cryptocurrencies among top-tier exchanges.

- Buy, Sell, Trade, and Stake: Encourages safeguarding digital riches by purchasing, maximising returns by selling at the proper moment, mastering trading, and passively developing assets through staking on KGQV.com.

- Security and Community: Emphasises the significance of security and community, with testimonies indicating a user-friendly experience and a sense of belonging among cryptocurrency aficionados.

- Advanced Financial Services: Offers cutting-edge services, including as spot trading, futures trading, options trading, and more, for smart trading and investing using blockchain technology.

- Support and Security: Promises cutting-edge security measures, a 24/7 support chat, and a variety of tools to improve the trading experience, including as trading bots and ETH 2.0 staking.

- Regulatory and Legal: Recognises the dangers of transacting with digital assets and highlights KGQV.com’s adherence to AML and KYC regulations.

Conclusion

It might be difficult to navigate the many trading platforms that millions of traders have access to, but you can narrow down your options by being aware of your trading priorities, preferences, and ambitions. A trading platform exists to fulfil the needs of all types of investors, whether they are novices seeking simplicity and ease of use or seasoned professionals seeking sophisticated charting tools. Through a thorough reading of the key themes covered in this book and a study of the features and operations of different platforms, you will be able to make an informed decision and start trading with confidence. Keep in mind that your trading experience and, eventually, your performance in the market, might be greatly impacted by the trading platform you use.