Everyone remembers getting a few dollars of pocket money for their chores, or a banknote in a card for their birthday or Christmas. You’d stash it away in a piggy bank or money tin until you had enough to warrant depositing it into your Dollarmites account at the bank.

There was a sense of accomplishment, and seeing that money grow in your account was awesome. Those money saving habits that young people built as kids still persists today, although now there’s a better understanding of how that money in the bank works for you. The understanding is that it doesn’t work that well for you at all, not in comparison to other investments.

You see, a micro investment app actually puts your money to work, and even though they’re fairly new financial tools, their historical returns are far superior to the interest earned in a bank account.

Let’s take a look at a few reasons for why micro investing apps have exploded in adoption and popularity.

They Offer Better Returns

Banks offer 2.5% a year on your savings at best, with minimum lock in periods and often needing minimum amounts in the thousands.

Some micro investing platforms have products earning 20% a year or more, and last year crypto micro investment apps returned many times higher than that, some also automatically reinvest your gains, so that your investment will snowball.

More People are Concerned about their Money

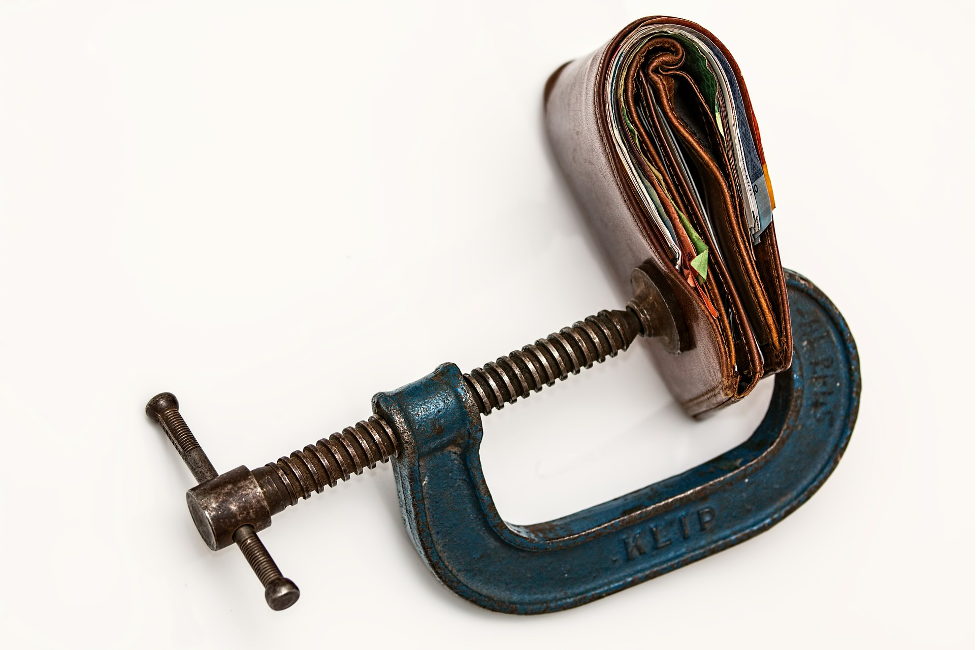

With rising inflation, a concern people have is that the interest rate earned on their savings isn’t enough to outpace the inflation rate, and currently, this is the case in Australia.

In 2021, the Australian inflation rate was 3.5%, even if you kept your money in a savings account with the interest rate mentioned earlier of 2.5%, your savings would unfortunately be worth 1% less due to the rise in inflation.

With a rising cost of living, and most concerned about saving enough for retirement, small and consistent contributions to an app with a good earnings yield can really make a difference when viewed over a few years, or even decades.

Low Barrier to Entry

As mentioned, high interest savings accounts through banks require thousands to get started. If you’re eyeing traditional trading platforms, they require a deposit of a few hundred dollars at a minimum, whilst also imposing minimum purchase amount requirements to boot, not to mention the hundreds a year you’ll pay in fees.

Micro investing apps typically only require a few dollars to get started, with most using a feature that rounds up your purchases to invest your digital “spare change”. Monthly fees are also not more than $3 to $4 at most, which when contrasted with the returns made, is a negligible sum for most.

It’s Easy and Convenient

Using a micro investment app is as simple as using a banking app, actually, it’s probably even easier. They only require a one time set up which involves linking your bank account, choosing which investment you want, then setting your contributions. Literally anyone can do that!

That type of “set-and-forget” investment method, which is also known as “dollar cost averaging”, is the safest type of strategy for new investors as they don’t have to try to time the market.

That level of convenience can’t be matched, whilst the long-standing investment platforms have made it easier to sign up, it’s still not something you can do over a beer with a mate, like you can with a micro investment app.

Shattered perceptions

It used to be that you needed a lot of money to invest in the financial markets, but micro investment apps have proven you don’t.

As that perception shattered, the wildfire adoption of these platforms by those yearning for a better way to save money took hold, making micro investment apps the modern day piggy bank.